Page 99 - Annual Report

P. 99

HONG KONG ACADEMY OF MEDICINE

香 港 醫 學 專 科 學 院

香港醫學專科學院

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2023

19. FINANCIAL INSTRUMENTS (Continued)

d) Currency risk

The Group’s functional currency is Hong Kong dollars. The Group is exposed to currency risk

through cash and bank balances denominated in Renminbi (“RMB”) and United States dollars

(“USD”). As the Hong Kong dollar (“HKD”) is pegged to the USD, the Group does not expect any

significant movements in the USD/HKD exchange rate. At 31 December 2023, it is estimated

that a general increase or decrease in 5% of exchange rates, with all variables held constant,

would increase/decrease the Group’s surplus for the year and increase/decrease the Group’s

general fund by approximately HK$17,000 (2022: HK$15,000).

e) Fair values measurement

Fair value hierarchy

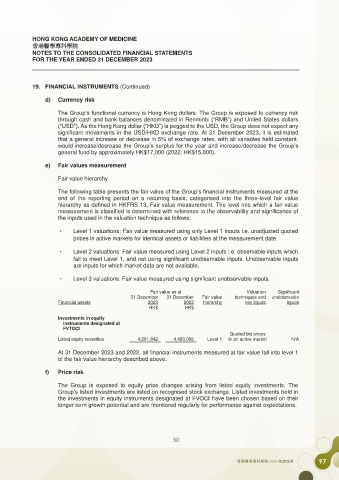

The following table presents the fair value of the Group’s financial instruments measured at the

end of the reporting period on a recurring basis, categorised into the three-level fair value

hierarchy as defined in HKFRS 13, Fair value measurement. The level into which a fair value

measurement is classified is determined with reference to the observability and significance of

the inputs used in the valuation technique as follows:

• Level 1 valuations: Fair value measured using only Level 1 inputs i.e. unadjusted quoted

prices in active markets for identical assets or liabilities at the measurement date.

• Level 2 valuations: Fair value measured using Level 2 inputs i.e. observable inputs which

fail to meet Level 1, and not using significant unobservable inputs. Unobservable inputs

are inputs for which market data are not available.

• Level 3 valuations: Fair value measured using significant unobservable inputs.

Fair value as at Valuation Significant

31 December 31 December Fair value techniques and unobservable

Financial assets 2023 2022 hierarchy key inputs inputs

HK$ HK$

Investments in equity

instruments designated at

FVTOCI

Quoted bid prices

Listed equity securities 4,261,842 4,483,002 Level 1 in an active market N/A

At 31 December 2023 and 2022, all financial instruments measured at fair value fall into level 1

of the fair value hierarchy described above.

f) Price risk

The Group is exposed to equity price changes arising from listed equity investments. The

Group’s listed investments are listed on recognised stock exchange. Listed investments held in

the investments in equity instruments designated at FVOCI have been chosen based on their

longer term growth potential and are monitored regularly for performance against expectations.

29 30 30

97

香港醫學專科學院 2024 年度報告