Page 86 - Annual Report

P. 86

HONG KONG ACADEMY OF MEDICINE

香 港 醫 學 專 科 學 院

香港醫學專科學院

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2023

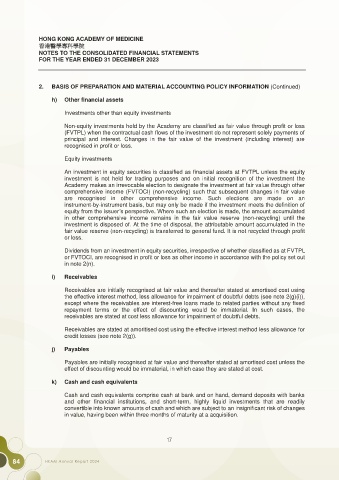

2. BASIS OF PREPARATION AND MATERIAL ACCOUNTING POLICY INFORMATION (Continued)

h) Other financial assets

Investments other than equity investments

Non-equity investments held by the Academy are classified as fair value through profit or loss

(FVTPL) when the contractual cash flows of the investment do not represent solely payments of

principal and interest. Changes in the fair value of the investment (including interest) are

recognised in profit or loss.

Equity investments

An investment in equity securities is classified as financial assets at FVTPL unless the equity

investment is not held for trading purposes and on initial recognition of the investment the

Academy makes an irrevocable election to designate the investment at fair value through other

comprehensive income (FVTOCI) (non-recycling) such that subsequent changes in fair value

are recognised in other comprehensive income. Such elections are made on an

instrument-by-instrument basis, but may only be made if the investment meets the definition of

equity from the issuer’s perspective. Where such an election is made, the amount accumulated

in other comprehensive income remains in the fair value reserve (non-recycling) until the

investment is disposed of. At the time of disposal, the attributable amount accumulated in the

fair value reserve (non-recycling) is transferred to general fund. It is not recycled through profit

or loss.

Dividends from an investment in equity securities, irrespective of whether classified as at FVTPL

or FVTOCI, are recognised in profit or loss as other income in accordance with the policy set out

in note 2(n).

i) Receivables

Receivables are initially recognised at fair value and thereafter stated at amortised cost using

the effective interest method, less allowance for impairment of doubtful debts (see note 2(g)(i)),

except where the receivables are interest-free loans made to related parties without any fixed

repayment terms or the effect of discounting would be immaterial. In such cases, the

receivables are stated at cost less allowance for impairment of doubtful debts.

Receivables are stated at amoritised cost using the effective interest method less allowance for

credit losses (see note 2(g)).

j) Payables

Payables are initially recognised at fair value and thereafter stated at amortised cost unless the

effect of discounting would be immaterial, in which case they are stated at cost.

k) Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and on hand, demand deposits with banks

and other financial institutions, and short-term, highly liquid investments that are readily

convertible into known amounts of cash and which are subject to an insignificant risk of changes

in value, having been within three months of maturity at a acquisition.

17

17

84 HKAM Annual Report 2024