Page 80 - Annual Report

P. 80

HONG KONG ACADEMY OF MEDICINE

香 港 醫 學 專 科 學 院

香港醫學專科學院

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2023

2. BASIS OF PREPARATION AND MATERIAL ACCOUNTING POLICY INFORMATION (Continued)

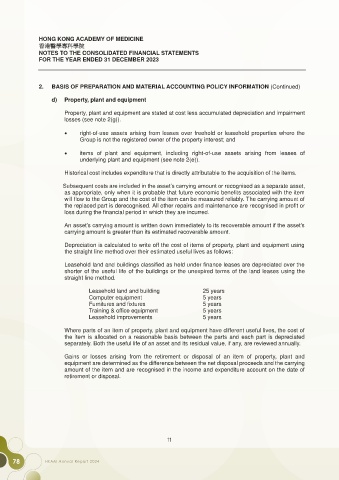

d) Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation and impairment

losses (see note 2(g)).

• right-of-use assets arising from leases over freehold or leasehold properties where the

Group is not the registered owner of the property interest; and

• items of plant and equipment, including right-of-use assets arising from leases of

underlying plant and equipment (see note 2(e)).

Historical cost includes expenditure that is directly attributable to the acquisition of the items.

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset,

as appropriate, only when it is probable that future economic benefits associated with the item

will flow to the Group and the cost of the item can be measured reliably. The carrying amount of

the replaced part is derecognised. All other repairs and maintenance are recognised in profit or

loss during the financial period in which they are incurred.

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s

carrying amount is greater than its estimated recoverable amount.

Depreciation is calculated to write off the cost of items of property, plant and equipment using

the straight line method over their estimated useful lives as follows:

Leasehold land and buildings classified as held under finance leases are depreciated over the

shorter of the useful life of the buildings or the unexpired terms of the land leases using the

straight line method.

Leasehold land and building 25 years

Computer equipment 5 years

Furnitures and fixtures 5 years

Training & office equipment 5 years

Leasehold improvements 5 years

Where parts of an item of property, plant and equipment have different useful lives, the cost of

the item is allocated on a reasonable basis between the parts and each part is depreciated

separately. Both the useful life of an asset and its residual value, if any, are reviewed annually.

Gains or losses arising from the retirement or disposal of an item of property, plant and

equipment are determined as the difference between the net disposal proceeds and the carrying

amount of the item and are recognised in the income and expenditure account on the date of

retirement or disposal.

11 11

78 HKAM Annual Report 2024