Page 98 - Annual Report

P. 98

HONG KONG ACADEMY OF MEDICINE

港

科

醫

學

專

院

學

香 香港醫學專科學院

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2022

19. FINANCIAL INSTRUMENTS (Continued)

d) Currency risk

The Group’s functional currency is Hong Kong dollars. The Group is exposed to

currency risk through cash and bank balances denominated in Renminbi (“RMB”) and

United States dollars (“USD”). As the Hong Kong dollar (“HKD”) is pegged to the USD,

the Group does not expect any significant movements in the USD/HKD exchange rate.

At 31 December 2022, it is estimated that a general increase or decrease in 5% of

exchange rates, with all variables held constant, would decrease/increase the Group’s

deficit for the year and increase/decrease the Group’s general fund by approximately

HK$15,000 (2021: HK$15,000).

e) Fair values measurement

Fair value hierarchy

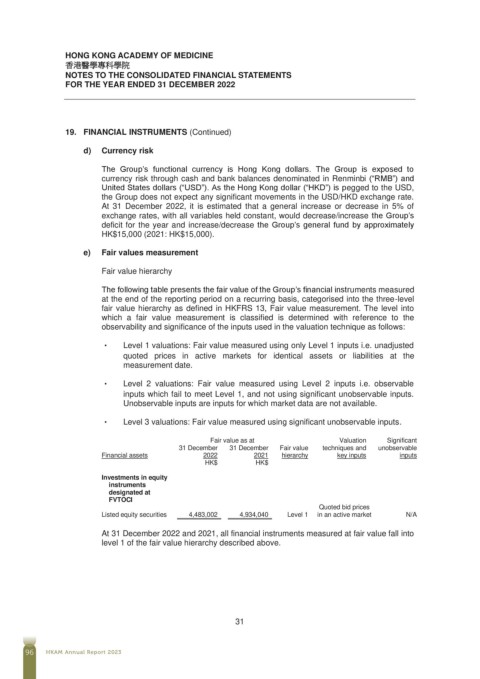

The following table presents the fair value of the Group’s financial instruments measured

at the end of the reporting period on a recurring basis, categorised into the three-level

fair value hierarchy as defined in HKFRS 13, Fair value measurement. The level into

which a fair value measurement is classified is determined with reference to the

observability and significance of the inputs used in the valuation technique as follows:

• Level 1 valuations: Fair value measured using only Level 1 inputs i.e. unadjusted

quoted prices in active markets for identical assets or liabilities at the

measurement date.

• Level 2 valuations: Fair value measured using Level 2 inputs i.e. observable

inputs which fail to meet Level 1, and not using significant unobservable inputs.

Unobservable inputs are inputs for which market data are not available.

• Level 3 valuations: Fair value measured using significant unobservable inputs.

Fair value as at Valuation Significant

31 December 31 December Fair value techniques and unobservable

Financial assets 2022 2021 hierarchy key inputs inputs

HK$ HK$

Investments in equity

instruments

designated at

FVTOCI

Quoted bid prices

Listed equity securities 4,483,002 4,934,040 Level 1 in an active market N/A

At 31 December 2022 and 2021, all financial instruments measured at fair value fall into

level 1 of the fair value hierarchy described above.

31

96 HKAM Annual Report 2023