Page 88 - Annual Report

P. 88

HONG KONG ACADEMY OF MEDICINE

香港醫學專科學院

學

醫

港

專

院

學

科

香

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2021

19. FINANCIAL INSTRUMENTS (Continued)

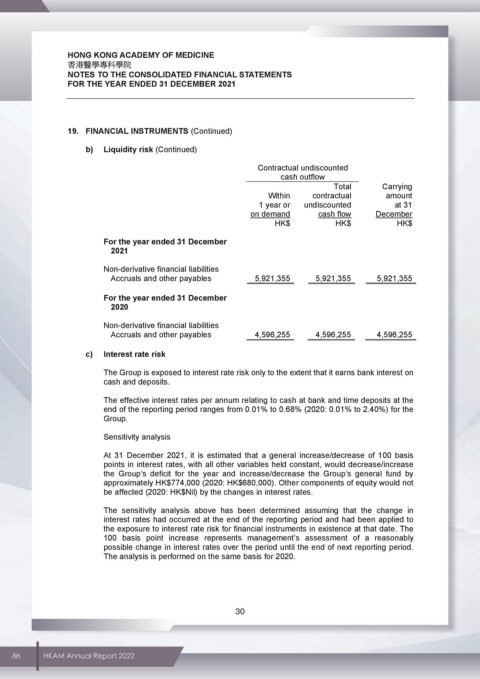

b) Liquidity risk (Continued)

Contractual undiscounted

cash outflow

Total Carrying

Within contractual amount

1 year or undiscounted at 31

on demand cash flow December

HK$ HK$ HK$

For the year ended 31 December

2021

Non-derivative financial liabilities

Accruals and other payables 5,921,355 5,921,355 5,921,355

For the year ended 31 December

2020

Non-derivative financial liabilities

Accruals and other payables 4,596,255 4,596,255 4,596,255

c) Interest rate risk

The Group is exposed to interest rate risk only to the extent that it earns bank interest on

cash and deposits.

The effective interest rates per annum relating to cash at bank and time deposits at the

end of the reporting period ranges from 0.01% to 0.68% (2020: 0.01% to 2.40%) for the

Group.

Sensitivity analysis

At 31 December 2021, it is estimated that a general increase/decrease of 100 basis

points in interest rates, with all other variables held constant, would decrease/increase

the Group’s deficit for the year and increase/decrease the Group’s general fund by

approximately HK$774,000 (2020: HK$680,000). Other components of equity would not

be affected (2020: HK$Nil) by the changes in interest rates.

The sensitivity analysis above has been determined assuming that the change in

interest rates had occurred at the end of the reporting period and had been applied to

the exposure to interest rate risk for financial instruments in existence at that date. The

100 basis point increase represents management’s assessment of a reasonably

possible change in interest rates over the period until the end of next reporting period.

The analysis is performed on the same basis for 2020.

30

30

86 HKAM Annual Report 2022