Page 67 - Annual Report

P. 67

HONG KONG ACADEMY OF MEDICINE

香港醫學專科學院

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2020

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

c) Basis of consolidation (Continued)

Consolidation of a structured entity begins when the Group obtains control over the

structured entity and ceases when the Group loses control of the structured entity.

Specifically, income and expenses of a structured entity acquired or disposed of during

the year are included in the consolidated statement of profit or loss from the date the

Group gains control until the date when the Group ceases to control the structured

entity.

When necessary, adjustments are made to the financial statements of structured entity

to bring its accounting policies in line with the Group’s accounting policies.

All intragroup assets and liabilities, equity, income, expenses and cash flows relating to

transactions between members of the Group are eliminated in full on consolidation.

d) Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation and

impairment losses (see note 3(g)).

- right-of-use assets arising from leases over freehold or leasehold properties

where the Group is not the registered owner of the property interest; and

- items of plant and equipment, including right-of-use assets arising from leases of

underlying plant and equipment (see note 3(e)).

Historical cost includes expenditure that is directly attributable to the acquisition of the

items.

Subsequent costs are included in the asset’s carrying amount or recognised as a

separate asset, as appropriate, only when it is probable that future economic benefits

associated with the item will flow to the Group and the cost of the item can be measured

reliably. The carrying amount of the replaced part is derecognised. All other repairs and

maintenance are recognised in profit or loss during the financial period in which they are

incurred.

An asset’s carrying amount is written down immediately to its recoverable amount if the

asset’s carrying amount is greater than its estimated recoverable amount.

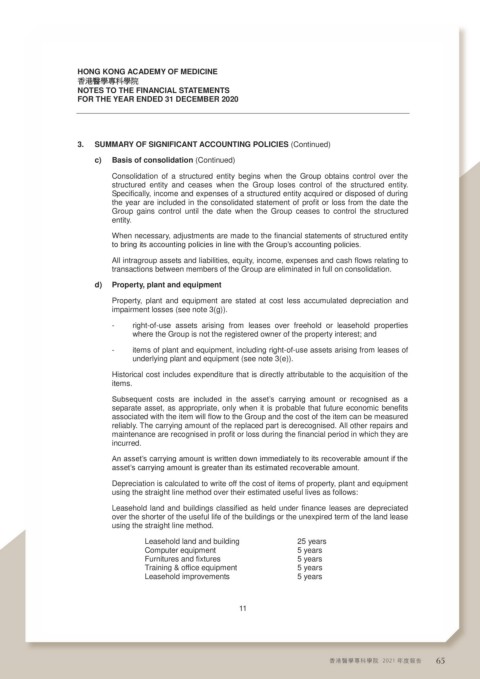

Depreciation is calculated to write off the cost of items of property, plant and equipment

using the straight line method over their estimated useful lives as follows:

Leasehold land and buildings classified as held under finance leases are depreciated

over the shorter of the useful life of the buildings or the unexpired term of the land lease

using the straight line method.

Leasehold land and building 25 years

Computer equipment 5 years

Furnitures and fixtures 5 years

Training & office equipment 5 years

Leasehold improvements 5 years

11

香港醫學專科學院 2021 年度報告 65